How do I read my auto insurance coverage policy? Your policy is a legal agreement, so at very first glimpse it can seem confusing.

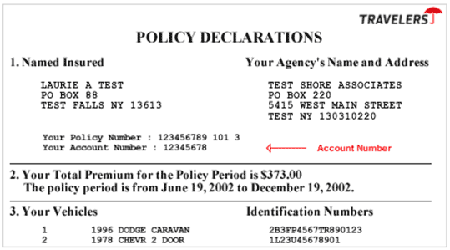

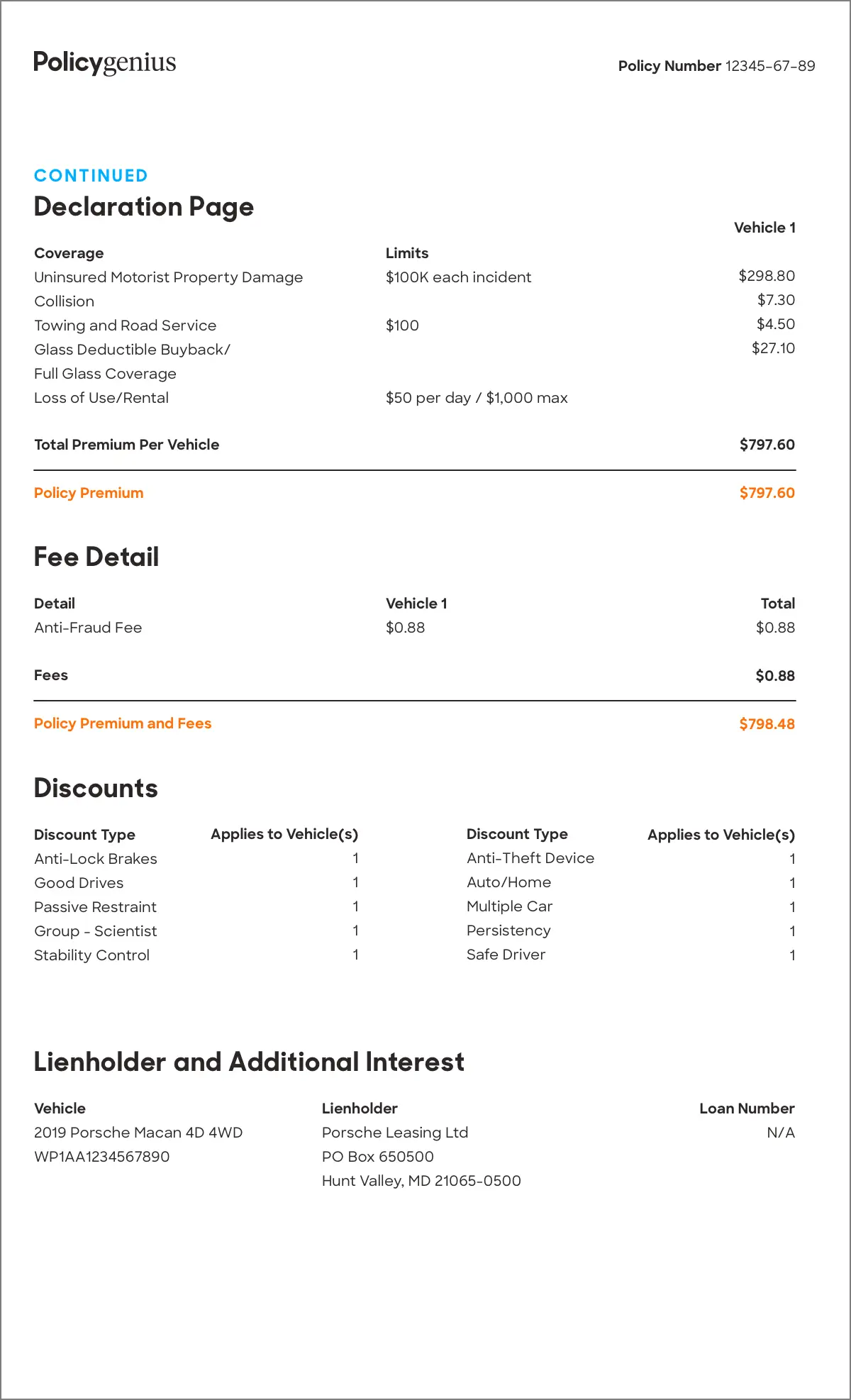

This is where you'll find your name, a statement of the policy duration throughout which you are covered as well as the amount of costs you pay - cheaper cars. The "dec" page likewise consists of a summary of the insurance coverage supplied and offers the optimal buck limit the insurance provider will pay for an insurance claim under each coverage.

This is the major component of the plan. It explains what the insurer will certainly perform in exchange for the costs you're paying. The guaranteeing arrangement will certainly also claim that is covered: The persons named as insureds on the affirmations page, citizens of the very same house and individuals utilizing the automobile with the consent of the guaranteed.

Problems of the plan. This last section defines your obligations when you have a claim, for example exactly how much time you have to report it and what documents you have to offer to the insurance policy business.

You can terminate your plan any time, nevertheless your insurance provider might only cancel under particular conditions and also with development notice to you - insurance companies.

Insuranceyes you have it, and also in certain situations you are asked to verify it. We also give your proof of insurance in designer black (lettering) and white (background) for those red rug occasions. How do I acquire evidence of insurance? All records except the SR-22 or FR-44 can be obtained on-line by checking out the policy documents section of our on-line service facility.

Top Guidelines Of Why You Need To See Your Employees' Auto Insurance Policy ...

Likewise, even more states are permitting digital ID cards as legitimate proof-of-coverage. Discover more about digital ID cards. If you are a GEICO insurance policy holder and also you recognize that you need an SR-22 or an FR-44 please call ( 877) 206-0215. If you are uncertain if you require an SR-22 or FR-44 or simply wish to find out more, keep reading for everything you require to recognize regarding an SR-22/ FR-44.

What is evidence of insurance coverage? To assist you on your method, below is an introduction of the various types of papers that might be described as "evidence of insurance policy:" the details that insurance ID cards contain vary by state yet normally the plan number, plan efficient days, automobiles and insurance holders are shown. cheap auto insurance.

Figure out exactly how to get dealt with rather after an injury or impairment in Iowa.

To get an automobile insurance coverage card, request one by logging right into your account on the auto insurance firm's web site or by calling customer solution. Exactly how to Get a Car Insurance Policy Card by Company When You Required an Auto Insurance Coverage Card 1. You obtain drawn over Authorities policemans generally ask for proof of insurance policy when they pull you over.

Your vehicle insurance policy card will certainly have every one of the info that the other driver requires if they prepare to file a responsibility insurance coverage claim. 3. You require to register your lorry In many states, the DMV requires you to have proof of insurance policy in order to register your vehicle or renew an existing enrollment. Your insurance firm will normally email you a momentary card or have you download one from their web site till a physical card can arrive in the mail. If your card is missing out on or consists of mistakes as well as you aren't able to offer evidence of insurance throughout a traffic stop, you will likely be ticketed for driving without insurance policy.

Everything about What Is A Declaration Page? - Scott Law Firm

Having a paper copy in your glovebox is still a smart back-up in situation of technical troubles, also. At the end of the day, preserving insurance coverage and maintaining a precise insurance card in your car can confirm that you have the required insurance coverage and also secure you from the penalties that feature driving uninsured: penalties, a suspended license, and also prison time.

The statements web page likewise notes the coverages as well as policy limits. Why You Required An Insurance Coverage Declaration Web Page There are a few reasons why you would require an insurance policy statement web page.

The statements page likewise lists the protections and limitations of the policy. It will also show the costs and also dates of insurance coverage. What An Insurance Affirmation Web Page Covers An insurance declaration page is a document that describes the particular protection that an insurance plan offers. It is likewise used to determine the parties entailed in the plan.

The paper will also specify the sort of insurance coverage limitations that are given, as well as the restrictions and exemptions - cheapest car. Where To Locate Your Insurance Declarations Pages You can discover your insurance statements web pages by calling your insurance provider. They will be able to provide you with a copy of the paper.

Different coverage types have different protection details on an insurance policy. The 2nd most common type of coverage is responsibility insurance.

What Is A Car Insurance Statement Web Page? A car insurance policy declaration page is a paper that lists the information of a cars and truck insurance policy - low cost. It includes the name of the insurance holder, the insurance firm's name, the lorry identification number, the make and design of the cars and truck, the type of protection, and also the plan duration.

All About What Is A Car Insurance Declarations Page?

/dotdash-TheBalance-what-is-an-insurance-declaration-page-2645728-final-6f2ec403156f423d95d11e3479cd1789.jpg) cheapest car insurance company low cost auto risks

cheapest car insurance company low cost auto risks

If your insurance plan is with a private insurance coverage representative, you may need to contact them to obtain a duplicate of your affirmations web page. Just How An Affirmations Page Is Various From An Insurance policy Policy A declarations page is a record that notes the things that are covered by an insurance coverage plan.

Why Is An Affirmations Web Page Important? A statements web page is essential due to the fact that it is a file that mentions the reliability of the details in the manuscript. It is also a paper that can secure the author from any kind of lawful activity that may be taken versus them. Various Kinds Of Insurance Declaration Pages (LIST) There are various insurance statement web pages, and also each kind offers a specific purpose.

cheap car insurance cheaper car insurance car cheap car

cheap car insurance cheaper car insurance car cheap car

If there are any kind of questions regarding your coverage, call your agent. Insurance Coverage Affirmation Page Car When you purchase car insurance coverage defense, you will be given an automobile insurance coverage declarations web page.

The part of the type that everybody who drives your auto should complete. This component is critical because it reveals just how lots of miles you go as well as if you use any person else's vehicles throughout this time. If someone aside from yourself uses your car, you must include their driving background and also age on the auto insurance declaration page, as well as they have to authorize it.

If you do not drive your auto, it is necessary to contact your insurance provider and also let them understand that another person will certainly be utilizing it. Failing to disclose this information might result in a non-renewal of your policy or termination if an accident occurs while a person else is utilizing your vehicle (accident).

The insurer will certainly suggest you if this is the situation. Insurance Declaration Page Life Every life insurance policy plan needs to be accompanied by an insurance policy affirmation web page, also for a member of the family. There are 2 various kinds of life insurance policy pages: This form only needs the insured and the recipient's details.

What Is A Homeowners Insurance Declaration Page? - Insurify Fundamentals Explained

automobile cars car insured cheap insurance

automobile cars car insured cheap insurance

The various other motorbikes do not require to be mentioned on the insurance coverage statement page. Is Affirmation The Exact Same As Evidence Of Insurance?

Legislation enforcement may ask for evidence of insurance coverage if they believe you are driving without insurance policy or confirming you have complete protection when in a crash with one more motorist who doesn't carry their auto obligation insurance coverage (cheap car). Consequently, your affirmations web pages should show all required information, including car identification number (VIN), permit plate numbers, contact information, etc, so there will be no concern whether or not you're guaranteed during such events.

The majority of insurance policy firms need some proof of insurance coverage. The proof of insurance can also be a letter from the insurance coverage company that verifies your coverage.

What Is The Initial Web Page Of An Insurance Policy Policy Called? The initial web page of an insurance plan is generally called the affirmations web page.

The affirmations web page additionally notes the protections and restrictions of the whole plan. It will likewise show the costs as well as days of protection. Just how To Get A Hold Of Your Declaration Web page If You Are Not The Key Insurance company If you are not the primary insurance provider on a policy, you might require to contact the insurance provider to obtain a duplicate of the statements web page.

If your insurance plan is with an individual insurance coverage representative, you might need to contact them to obtain a duplicate of your declarations page. What Is A Plan Duration? The policy duration is the length of time that the insurance policy company accepts offer insurance coverage. If you purchased an one-year car plan, you would be covered for crashes during that time frame.

The Best Guide To Frequently Asked Questions – Automobile Insurance

Loss Payee A loss payee is an individual or entity that will certainly be given the proceeds of a life insurance coverage policy when the insured passes away. Insurance Agent An insurance policy agent is a professional that helps individuals and services get insurance coverage.

A home loan lending institution is an organization that gives home loans to borrowers. The home loan business will certainly assess the debtor's financial scenario and also establish if they are eligible for a home loan.

credit score car insurance accident cars

Review on to learn what the insurance affirmation web page is as well as why it's crucial. What Is the Insurance Coverage Declaration Web Page?

, but the declaration page supplies an excellent review of what's consisted of.

Inspect that the agreement terms are as you consented to, consisting of any type of discount rates you anticipated, which the names and addresses are all right. insurance affordable. If there are any typos or various other mistakes, have them remedied asap. Furthermore, if you're unsure about an offered term or some element of protection, contact your insurance representative or representative for a comprehensive explanation, or to fix the plan and issue a changed affirmation web page.

You should check the new web page to see if your insurer has changed any kind of terms, or to check whether you could be eligible for much better coverage or extra discounts back https://autoinsurancelittlevilla.z12.web.core.windows.net/ then. Last but not least, keep the insurance policy declaration web page in a refuge given that it is a vital part of your legitimately binding insurance contract. liability.

Not known Details About 6489.nv.0616.pdf

insurance cheapest car prices cheaper

insurance cheapest car prices cheaper

Examine the plan statements web page to make certain the details is right. When you're done confirming your affirmations page, store it, along with the full policy, in a risk-free area.

The affirmation web page or "dec web page" of your vehicle insurance policy is the very first as well as among one of the most vital web pages on the record. It supplies an in-depth recap of the specifics included on the file as well as has the majority of the information that you would certainly need when asking inquiries or reporting a claim to the insurer (low-cost auto insurance).

We've placed together a guide to help navigate it and also better comprehend your plan. Below's a run-through of the areas you must review to make sure all the data is right: First thing should be the name and also address of the insured as well as primary vehicle driver (typically you) of the insured lorry. insured car.